This summer, Evans School Associate Professor Crystal Hall, and recent alumni Puja Kumar (MPA ’20) and Sehej Singh (MPA’20) worked with the U.S. Office of Evaluation Sciences (OES) and Small Business Administration (SBA) to conduct a descriptive study of local grant and loan programs using public information about funding programs and conversations with local officials. OES documented the approaches local governments took in disbursing funding, the common challenges encountered by officials and applicants, and how these relate to SBA’s access goals.

November 24, 2020

Evans School researchers document approaches and challenges in ensuring access to small business grant and loan programs during COVID-19

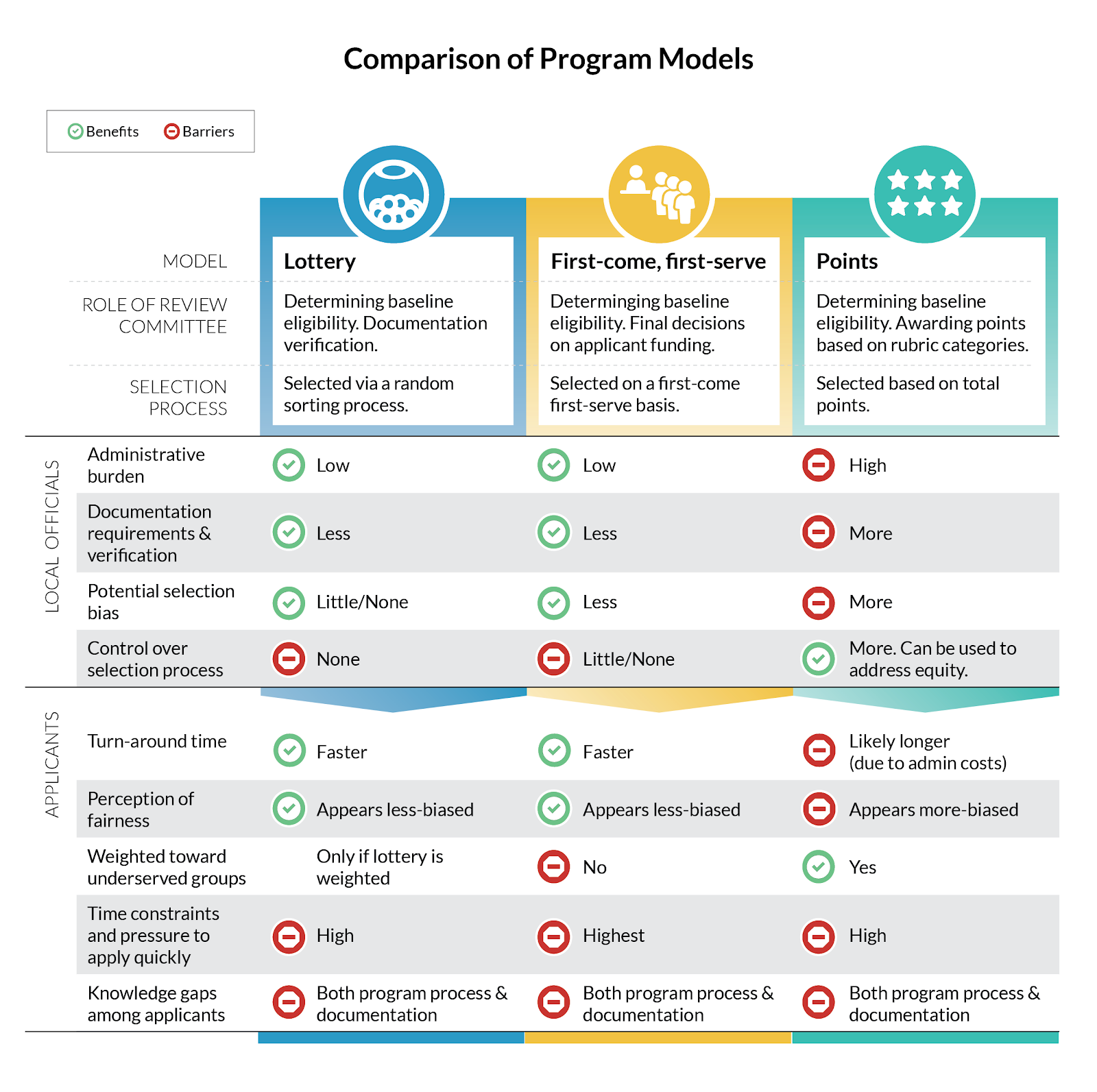

The demand for COVID-relief funding for small businesses was massive. Many local governments attempted to address concerns about access for business owners from historically underserved groups, but even those with similar aims often took different approaches, given the lack of evidence to inform program design. Regardless of the program model, there were several challenges for the local officials and potential applicants. There is reason to think that some of these challenges may increase the barriers to accessing capital for members of historically underrepresented groups, in particular minorities.

In sum, this work showed strong demand for evidence to inform program designs which address these challenges and increase access to small business grants and loan programs for historically underserved groups. More can be done to systematically address the lack of evidence to prepare the way for future programming.